Table of Contents

So, you’ve navigated the exciting world of Bitcoin, maybe you’ve seen some growth from your investment (is Bitcoin a good investment? Check our thoughts here), or perhaps you need access to your funds in your local currency. Whatever the reason, you’re asking the crucial question: how do I withdraw Bitcoin to bank account? You’re not alone! Knowing how to cash out Bitcoin safely and efficiently is a vital skill for any crypto holder in 2025.

Turning digital assets into spendable cash might seem daunting, but it’s usually quite straightforward once you understand the process. Choosing the right bitcoin withdrawal method is key – factors like fees, speed, and security vary significantly. Getting this wrong can lead to unexpected costs or delays.

TL;DR / Quick Summary:The most common way to withdraw Bitcoin to a bank account is using a Centralized Crypto Exchange (CEX) like Coinbase or Binance. You’ll typically deposit your BTC to the exchange, sell it for your local fiat currency (like USD or EUR), and then initiate a withdrawal from the exchange directly to your linked and verified bank account.

This guide will walk you through the most popular ways to transfer Bitcoin to bank accounts, including using exchanges (CEXs), Peer-to-Peer (P2P) platforms, and even Bitcoin ATMs (though usually for cash). We’ll cover everything you need to know to confidently convert Bitcoin to cash that lands right where you need it.

Before You Withdraw: Essential Prerequisites

Before you begin the process of converting Bitcoin into cash through a bank account, ensure you have the following set up:

- Bitcoin Access: Your Bitcoin needs to be accessible, either in a personal wallet where you control the private keys or already held within an account on a crypto exchange.

- Verified Platform Account: You’ll need an account with a platform that facilitates crypto to bank account transfers. For most methods, this means a verified account on a reputable crypto exchange. Verification often involves submitting ID documents (KYC – Know Your Customer).

- Linked Bank Account: If using a CEX, your bank account must be linked to your exchange account and typically verified through small test deposits or login credentials via a service like Plaid.

- Basic Security Setup: Ensure essential security measures are active on your exchange account and email, primarily Two-Factor Authentication (2FA). Be aware of common phishing scams.

Method 1: Using a Centralized Crypto Exchange (CEX) – The Most Common Way

This is the go-to method for most people looking to cash out Bitcoin. It’s generally user-friendly and offered by major, established platforms.

What is a CEX?

A Centralized Crypto Exchange (CEX) acts as a middleman, matching buyers and sellers of cryptocurrencies. Think of well-known platforms like Coinbase, Binance, Kraken, Gemini, etc. They provide the infrastructure to trade crypto for fiat money (like USD, EUR, GBP) and facilitate the bitcoin to fiat withdrawal to your bank.

Step-by-Step Guide:

- Choose & Verify Your Exchange: Select a reputable CEX available in your region that supports BTC/fiat trading pairs for your currency and allows bank withdrawals. Complete their identity verification (KYC) process.

- Deposit Bitcoin to the Exchange: If your Bitcoin is in an external wallet, generate a BTC deposit address on the exchange and send your Bitcoin to it. Wait for the required network confirmations.

- Sell Bitcoin for Fiat Currency: Head over to your crypto exchange’s trading section to convert your Bitcoin into traditional money. Place a sell order for your Bitcoin, specifying the fiat currency you want (e.g., sell BTC for USD). Wait for the order to be filled.

- Link and Confirm Your Bank Account: Navigate to the account settings or withdrawal area of your exchange to connect your bank. Ensure you enter your bank account details, such as your account number and routing number. You might need to verify ownership via small deposits or linking through a secure third-party service.

- Initiate the Fiat Withdrawal to Your Bank: Once your bank account is linked and your fiat balance reflects the sale, select the ‘Withdraw’ option for your fiat currency. Choose your linked bank account, enter the amount, and review any fees. Confirm the withdrawal (often requires 2FA). Knowing how I get my money out of Binance US or other exchanges involves this specific step. See specific tips on Binance US withdrawals.

- Confirmation & Waiting Period: The exchange will process the withdrawal. Depending on the method (e.g., ACH, SEPA, Wire Transfer) and your bank, it can take anywhere from a few hours to several business days for the funds to appear in your bank account.

Pros:

- User-Friendly: Generally intuitive interfaces designed for ease of use.

- Relatively Secure: Reputable exchanges invest heavily in security (though holding large amounts long-term on an exchange carries risks).

- High Liquidity: Allows for the quick sale of Bitcoin at prevailing market prices.

Cons:

- KYC Required: Mandatory identity verification is needed.

- Lack of Control Over Keys: While using the exchange, you do not have control over the Bitcoin private keys.

- Withdrawal Limits: Exchanges often impose daily or transaction limits.

- Potential Delays: Processing times can vary.

Typical Fees & Speed:

Bitcoin withdrawal fees on CEXs come in layers:

- Trading Fees: A small percentage when you sell BTC for fiat (e.g., 0.1% – 0.6%).

- Fiat Withdrawal Fees: Varies greatly. ACH/SEPA transfers are often free or low-cost (0−0.5), while Wire Transfers can be more expensive (10−30+). Check your exchange’s specific fee schedule Coinbase Help.

- Understanding these is key to avoiding withdrawal fees on Binance US or similar platforms.

- Speed: ACH/SEPA usually takes 1-5 business days. Wires can be faster (same day or next day) but cost more.

Security Considerations for CEX:

- Enable 2FA (Authenticator App preferred over SMS).

- Use a strong, unique password.

- Consider enabling withdrawal address whitelisting if available.

- Beware of phishing emails/sites pretending to be your exchange.

Method 2: Peer-to-Peer (P2P) Platforms

P2P platforms offer a different way to sell bitcoins directly to another individual, with the platform acting as an escrow service.

What is P2P?

Platforms such as Binance P2P or Paxful facilitate direct connections between buyers and sellers. You can create an offer to sell your Bitcoin, indicating your price and preferred payment options, including bank transfers.

How it Works:

You find a buyer interested in your offer. Once they initiate the trade, your Bitcoin is held in escrow by the platform. The buyer will deposit the agreed fiat amount directly into your bank account (or another payment method you chose). After confirming the payment has been received, you’re ready to release the Bitcoin held in escrow to the buyer.

Step-by-Step Overview:

- Register and verify on a P2P platform.

- Create an advertisement (ad) to sell BTC, specifying amount, price, and accepted bank transfer details.

- Wait for a buyer to open a trade based on your ad.

- Communicate with the buyer via the platform’s chat.

- Wait for the buyer to send the payment directly to your bank account and mark it as paid.

- Crucially: Verify the funds have arrived and cleared in your bank account independently.

- Once confirmed, release the Bitcoin from escrow on the P2P platform.

Pros:

- Potentially Better Rates: You can often set your own price.

- More Payment Options: Wide variety of payment methods usually supported beyond just bank transfers.

- Sometimes Less Stringent KYC: Depending on the platform and transaction size/region.

Cons:

- Higher Scam Risk: Requires diligence to avoid fraudulent buyers (e.g., fake payment proof, chargeback attempts). Always verify funds in your bank account.

- Potentially Slower: Relies on finding a suitable buyer and coordinating the transaction.

- More Complex: Can be less straightforward than using a CEX, especially for beginners.

Typical Fees & Speed:

Sellers often enjoy reduced fees (sometimes none at all), though the exchange rate may not be as favorable as what centralized exchanges offer. Speed depends entirely on finding a buyer and how quickly they pay and you confirm.

Security Considerations for P2P:

- ALWAYS verify payment directly in your bank account before releasing Bitcoin. Avoid trusting only screenshots or payment confirmations from the buyer—always verify the funds yourself.

- Check the buyer’s reputation/trade history on the platform.

- Use the platform’s escrow service diligently.

- Be wary of buyers pressuring you to release BTC before confirming payment. This focus on secure bitcoin withdrawal is paramount here.

Method 3: Bitcoin ATMs

While often associated with buying Bitcoin, some Bitcoin ATMs also allow you to sell BTC for cash. Direct bank account withdrawal via ATM is less common but worth mentioning.

How Bitcoin ATMs Work for Withdrawals (Sell Function):

You interact with the ATM, indicate you want to sell Bitcoin, and it provides a QR code/wallet address. Send your Bitcoin from your wallet to the designated address provided by the platform or buyer. Once the blockchain confirms your transaction, the Bitcoin ATM will dispense your cash. Some advanced ATMs might offer options for bank transfers, but this is rare and usually involves higher scrutiny or prior setup. The primary function is how do I turn Bitcoins into cash physically.

Step-by-Step Overview (for Cash):

- Find a nearby Bitcoin ATM that allows BTC sales by using tools like Coin ATM Radar or similar locator services.

- Select the ‘Sell’ option on the ATM screen.

- Indicate how much Bitcoin you wish to sell.

- The ATM will display a BTC address (QR code) and the exchange rate (usually poor).

- Transfer the precise Bitcoin amount from your wallet to the given address.

- Wait for blockchain confirmation (can take 10 mins to over an hour).

- After the transaction is verified, the ATM either gives you cash or issues a withdrawal code.

Pros:

- Fast Cash: Quickest way to get physical cash for Bitcoin.

- Potentially Higher Privacy: KYC can sometimes be less stringent for smaller amounts compared to exchanges (though increasingly required).

Cons:

- Very High Fees: Transaction fees and poor exchange rates are common (can be 7-20%+).

- Limited Availability: ATMs aren’t everywhere.

- Restrictive Limits: These platforms typically impose strict caps on the amount you can sell.

- Primarily Cash: Usually doesn’t facilitate direct transfer bitcoin to bank account.

Typical Fees & Speed:

Expect significantly higher fees than CEXs or P2P. The speed at which cash is dispensed depends on how quickly the blockchain transaction is confirmed.

Security Considerations:

- Be aware of your physical surroundings when using an ATM.

- Ensure the ATM is legitimate and not tampered with.

- Double-check the sending address.

(Optional) Method 4: Crypto Debit Cards

While not a direct withdraw bitcoin to bank account method, crypto debit cards (like those from Crypto.com, Coinbase, etc.) offer a way to spend your crypto value easily. You top up the card account by selling crypto for fiat within their app, and then use the card like any normal debit card online or in stores. Funds are spent from the fiat balance, not directly from Bitcoin at the point of sale. It’s a convenient way to access the value without a formal bank withdrawal.

Crucial Factors to Consider When Withdrawing Bitcoin

Choosing how you cash in bitcoins involves more than just picking a platform. Consider these vital factors:

Withdrawal Fees

Fees can eat into your funds! Be aware of:

- Exchange Trading Fees: Charged when selling BTC for fiat.

- Bitcoin Network Fees: Paid when sending BTC to an exchange (if applicable), varies with network congestion.

- Fiat Withdrawal Fees: Charged by the exchange to send money to your bank. Can be fixed or percentage-based. Varies hugely by method (ACH vs. Wire) and exchange.

- Bank Fees: Your own bank might charge fees for incoming wires.

Conceptual CEX Fee Comparison (Illustrative – Always Check Official Pages):

| Feature | Exchange A (e.g., Coinbase) | Exchange B (e.g., Kraken) | Exchange C (e.g., Binance) | Notes |

| Trading Fee | Maker/Taker ~0.4-0.6% | Maker/Taker ~0.16-0.26% | Maker/Taker ~0.1% | Tiers often reduce fees with volume |

| ACH Withdrawal | Often Free | Often Free (US) | Supported? (Varies by region) | Check availability & limits |

| SEPA Withdrawal | Low Cost (~€0.15) | Low Cost (~€1) | Low Cost (~€1) | For Euro bank accounts |

| Wire Withdrawal | ~10(US), 10(US), 25 (Int’l) | ~5−5−35 (Varies) | ~15−15−35 (Varies by region) | Faster but more expensive |

Withdrawal Speed & Processing Times

Need your funds quickly? Consider this:

- Exchange Processing: How long the CEX takes internally to approve and send the withdrawal (can be instant to 1-2 days).

- Bank Processing: How long your bank takes. ACH/SEPA: 1-5 business days. Wire Transfers: Same day or next business day usually. The fastest way to withdraw bitcoin value to your bank is often via wire transfer, but it costs more.

Withdrawal Limits

Platforms impose limits:

- Daily/Weekly/Monthly Limits: Based on your verification level.

- Per Transaction Limits: Maximum amount per single withdrawal.

- Check these limits before you start the process if moving large amounts.

KYC/AML Requirements

Bitcoin KYC withdrawal is standard practice on regulated platforms. To comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) standards, exchanges are required to verify user identities to help prevent illegal activities. Expect to provide:

- Government-issued ID (Passport, Driver’s License)

- Proof of Address (Utility bill, bank statement)

- Sometimes a selfie or video verification.

Security Best Practices (Secure Bitcoin Withdrawal Checklist)

Protect yourself during the crypto to bank account process:

- ✅ Double/Triple-Check Addresses: When depositing BTC to an exchange, ensure the address is correct. Bitcoin transactions are irreversible.

- ✅ Enable 2FA Everywhere: Use an authenticator app (Google Auth, Authy) on your exchange account and associated email. Avoid SMS 2FA if possible.

- ✅ Beware of Phishing: Verify website URLs (use bookmarks). Be suspicious of emails/messages asking for login details, 2FA codes, or initiating unexpected withdrawals.

- ✅ Secure Exchange Account: Use a strong, unique password. Consider withdrawal whitelisting.

- ✅ Secure Email: Your email is often the key to resetting passwords. Protect it rigorously.

- ✅ Use Secure Networks: Avoid making transactions on public Wi-Fi.

Tax Implications (Disclaimer Essential)

It’s important to note that in most places, including the U.S., selling Bitcoin for cash typically triggers a taxable event. This means you may owe capital gains tax on any profit you made from the Bitcoin’s appreciation.

- This is NOT tax advice. Regulations vary by country and change frequently.

- Keep detailed records of your Bitcoin purchase and sale dates, along with the transaction amounts.

- Consult with a qualified tax professional who understands cryptocurrency regulations in your jurisdiction to understand your specific obligations regarding bitcoin taxes withdrawal.

- Official resources like the IRS guidance on virtual currency (for US residents) can provide foundational information.

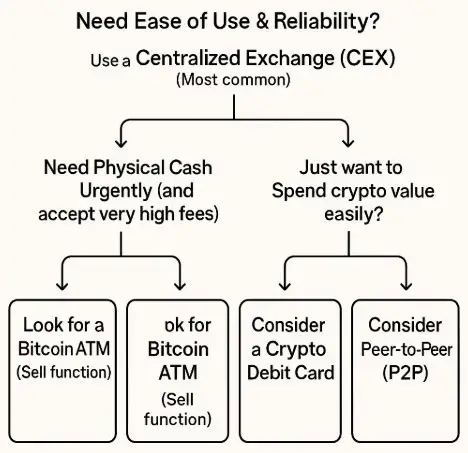

Which Method is Right for You? (Decision Guide)

- Need Ease of Use & Reliability? -> Use a Centralized Exchange (CEX). (Most common)

- Prioritize Potentially Better Rates / More Payment Options (and accept higher risk/complexity)? -> Consider Peer-to-Peer (P2P).

- In urgent need of cash and willing to deal with steep transaction fees? -> Look for a Bitcoin ATM (Sell function).

- Just want to Spend crypto value easily? -> Consider a Crypto Debit Card.

Common Pitfalls & How to Avoid Them

- Always double-check addresses before sending Bitcoin, as sending it to the wrong one can’t be reversed. Always ensure to carefully copy and paste the address and double-check the first and last few characters.

- Falling for Phishing Scams: Never click suspicious links or give out sensitive info. Exchanges will never ask for your password or two-factor authentication (2FA) codes via email or chat.

- Ignoring Fees: Factor in all potential fees (trading, network, withdrawal) before starting.

- Forgetting Tax Obligations: Understand the tax implications before you sell. Consult a professional.

- Using Unsecured Networks: Stick to trusted, private Wi-Fi or cellular data for transactions.

Conclusion & Key Takeaways

Successfully managing to withdraw Bitcoin to bank account facilities is a key part of the crypto journey. While how do you sell bitcoins might seem complex initially, the process is manageable by choosing the right method and proceeding with caution.

Key Takeaways:

- Centralized Exchanges (CEXs) are the most common, user-friendly method for bitcoin to fiat withdrawal.

- P2P platforms offer flexibility but require more diligence against scams.

- Bitcoin ATMs are often used for quick cash withdrawals, but they typically come with higher fees.

- Always prioritize security: Use 2FA, strong passwords, and beware of phishing.

- Factor in fees, speed, and limits when choosing your method.

- Be aware of your tax responsibilities — selling Bitcoin usually comes with tax implications.

Always double-check the specific procedures and fee schedules on your chosen platform, as they can change. By following the steps outlined here and staying cautious, you can smoothly convert your Bitcoin into bank funds whenever necessary.

Frequently Asked Questions (FAQ)

What’s the typical processing time to transfer Bitcoin funds to a bank account?

It varies. Selling on a CEX is fast, but the bank transfer takes time: 1-5 business days for ACH/SEPA, potentially faster (same/next day) for more expensive Wire transfers. P2P speed depends on finding and coordinating with a buyer.

What are the cheapest ways to withdraw Bitcoin?

Generally, using a CEX with free or low-cost ACH/SEPA withdrawal options is the most cost-effective. P2P can sometimes offer good rates with low platform fees, but scam risks are higher. Bitcoin ATMs usually charge the highest fees compared to other cash-out options. Check specific exchange fee structures.

Can I withdraw Bitcoin directly to my bank without an exchange?

Generally, no. Banks don’t typically interact directly with the Bitcoin network. You need an intermediary service (like an exchange or P2P platform) to convert Bitcoin to cash (fiat currency) first, which can then be sent to your bank.

Do I need to pay taxes when I withdraw Bitcoin? Is it possible to convert Bitcoin to cash without triggering tax obligations?

In most places, yes, selling Bitcoin for fiat money is a taxable event if you realized a profit. You generally can cash out bitcoins for real money, but claiming you don’t owe taxes if you made a profit is usually incorrect and risky. Tax laws vary; consult a tax professional.

Is it safe to link my bank account to a crypto exchange?

Trusted exchanges implement security protocols (such as encryption and services like Plaid) to safeguard your personal information. However, risks always exist with any online service. Use strong passwords, enable 2FA, and only use well-known, regulated exchanges. Never share your bank login details directly with unknown parties.

Disclaimer: This guide is for informational purposes only and does not constitute financial or tax advice. Always conduct your own research and consult with qualified professionals before making financial decisions or determining tax liabilities.